Shaking the market with a groundbreaking announcement on July 28th, Kazuo Ueda, the Governor of the Bank of Japan, unveiled a significant shift in the Yield Curve Control (YCC) policy.

While the 10-Year JGB Yield Target Range remains steady at ±0.5%, these upper and lower bounds are now regarded as mere reference points. The Bank is set to exercise a more adaptable approach and has outlined plans to procure 10-year Japanese Government Bonds (JGBs) at a fixed rate of 1% in the future.

As the world’s third-largest economy, will this adjustment to Yield Curve Control (YCC) policy trigger a butterfly effect? What does the shift of YCC policy truly signify?

This article aims to delve into the essence of this YCC policy, explore the key reasons behind the Bank of Japan’s decision to ease YCC, and analyze the impact of this policy adjustment on global markets.

What Is The Yield Curve Control (YCC) Policy?

The Yield Curve Control (YCC) policy is an initiative introduced by the Bank of Japan to address the challenges of prolonged low inflation and economic growth.

At its core, the YCC policy involves market intervention through the purchase of government bonds to maintain a stable environment of low long-term interest rates. This approach aims to stimulate lending, encourage investments, and subsequently drive inflation and economic activity.

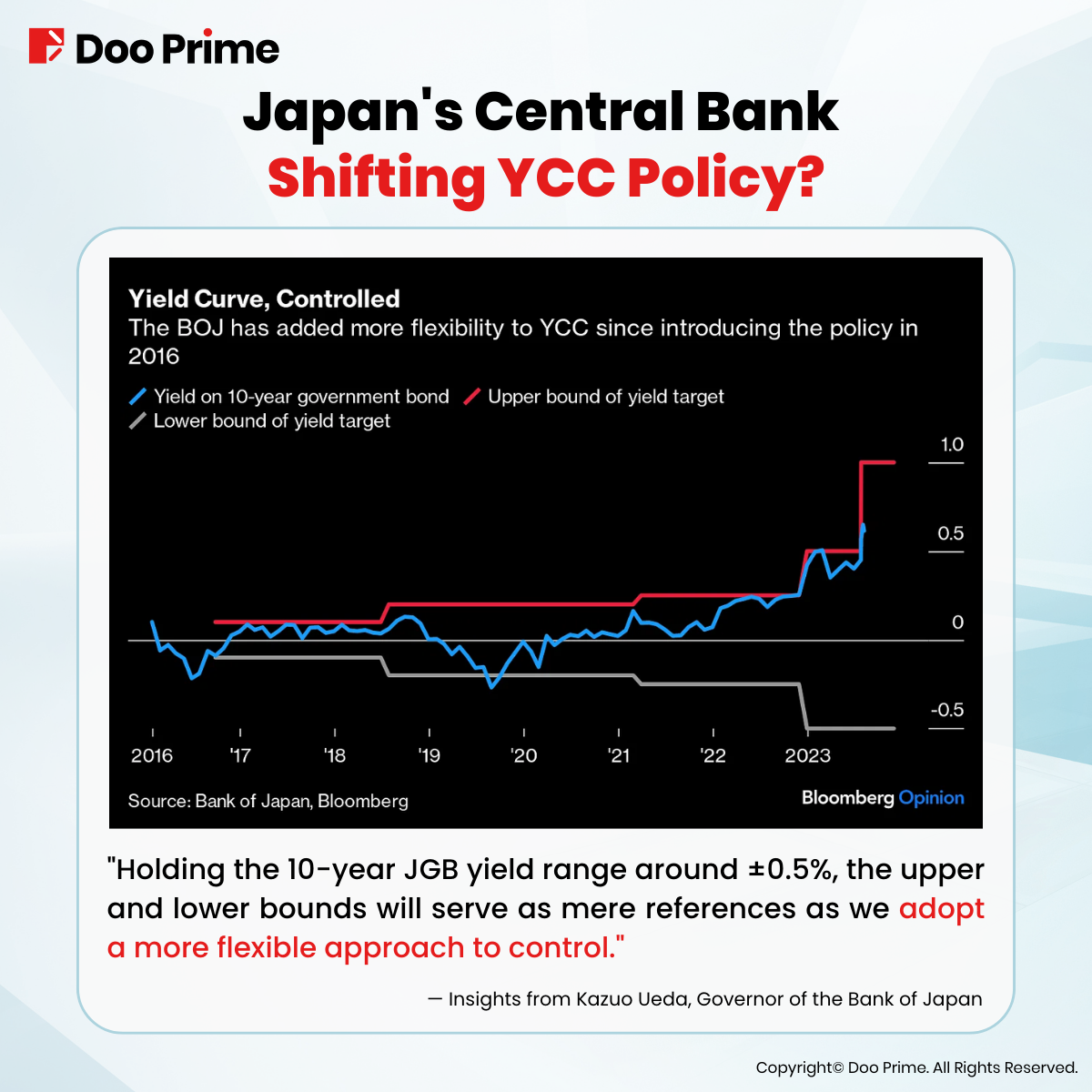

In January 2016, the Bank of Japan unveiled the YCC policy, reducing the policy target rate to -0.1%, marking Asia’s first implementation of a negative interest rate policy.

In September of the same year, the Bank further declared a short-term interest rate target of -0.1% and a long-term interest rate target of 0%, with a range of fluctuation of approximately ±0.1%. This effectively kept the 10-year Japanese Government Bond (JGB) yield within the range of -0.1% to 0.1%.

Subsequently, the Bank of Japan made adjustments to the fluctuation range of long-term interest rates in 2018, 2021, and 2022. In 2018, the Bank expanded the fluctuation range for the 10-year JGB yield to ±0.2%.

In 2021, it further widened the range to ±0.25%, and in 2022, the Bank made its third adjustment to the YCC policy by extending the fluctuation range to ±0.5%.

While affirming its commitment to maintaining the 10-year JGB yield target range within ±0.5% during its July 2023 interest rate decision, the Bank of Japan indicated a newfound flexibility in its YCC control approach. The upper and lower bounds, previously considered strict parameters, are now acknowledged merely as points of reference.

Additionally, the Bank hinted at prospective acquisitions of 10-year JGBs at an elevated fixed rate of 1%, surpassing the previous 0.5% threshold. This move was interpreted by the market as a substantial easing of the YCC policy, possibly marking the first step toward tapering ultra-loose monetary policy.

As of now, Japan remains the sole major economy to persistently maintain negative interest rates and utilize YCC to control long-term government bond rates.

The decision by the Bank of Japan, under the leadership of its newly appointed Governor Kazuo Ueda, to effectively raise the upper limit of the 10-year government bond yield to 1% has taken markets by surprise.

This unexpected move has triggered volatility across the global financial landscape, impacting the Japanese yen, JGBs, Japanese stocks, and sovereign bonds worldwide.

Why Did The Bank Of Japan Shift The Yield Curve Control (YCC) Policy?

In the wake of the July interest rate decision, a pivotal press conference held by Kazuo Ueda revealed a crucial adjustment to the Bank of Japan’s Yield Curve Control (YCC) policy.

Amidst this announcement, Ueda acknowledged that the Bank had consistently underestimated the upward push on prices. However, the current economic landscape is far from the stable inflation and wage growth sought after, and the elusive 2% inflation target remains a distant reality.

With inflation risks tilting towards an upward trajectory and an air of uncertainty shrouding economic prospects, the emergence of exacerbated inflation could potentially unleash significant repercussions triggered by the YCC policy.

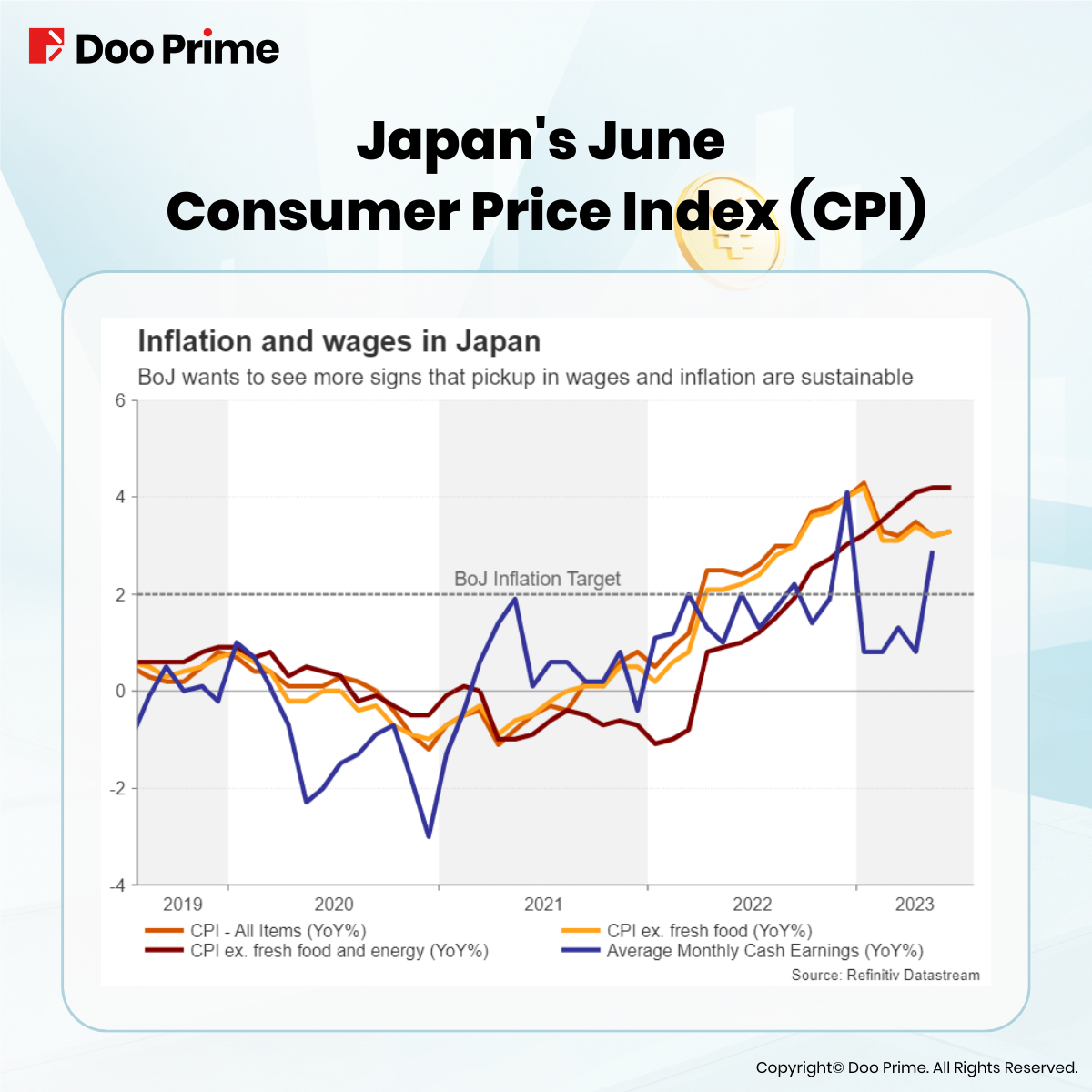

Ueda’s statements shed light on the primary reason for the YCC policy adjustment – inflationary pressure. The current inflationary pressure in Japan is persistent, with the June Consumer Price Index (CPI) at 105.0, marking a year-on-year increase of 3.3%, extending a streak of 22 consecutive months of growth.

Simultaneously, the core CPI, which excludes the more volatile food and energy prices, rose by 4.2% year-on-year, maintaining a 15-month streak of exceeding the Bank of Japan’s 2% inflation target.

In addition, the Bank of Japan substantially revised its inflation forecasts for 2023. The median expectation for core CPI in April stood at merely 1.8%, but it has now been revised upwards by 0.7% to 2.5%. The year-on-year growth rate for core CPI was similarly adjusted, from an anticipated range of 2.5%-2.7% in April to 3.1%-3.3%.

Survey data from the Bank of Japan also indicates that Japanese residents’ short-term and medium-term inflation expectations remained elevated in June. 28.2% of respondents believed that prices would significantly rise over the next year, while 37.1% anticipated a substantial increase in price levels over the next five years.

The elevated pace of inflation and inflation expectations provide a rational and necessary basis for the Bank of Japan’s adjustment to the YCC policy.

The Unforeseen Impacts Of The Yield Curve Control (YCC) Policy Shift

The unexpected recalibration of the YCC policy has ignited a series of consequential effects, widely perceived as the initial shift towards a tightening monetary stance.

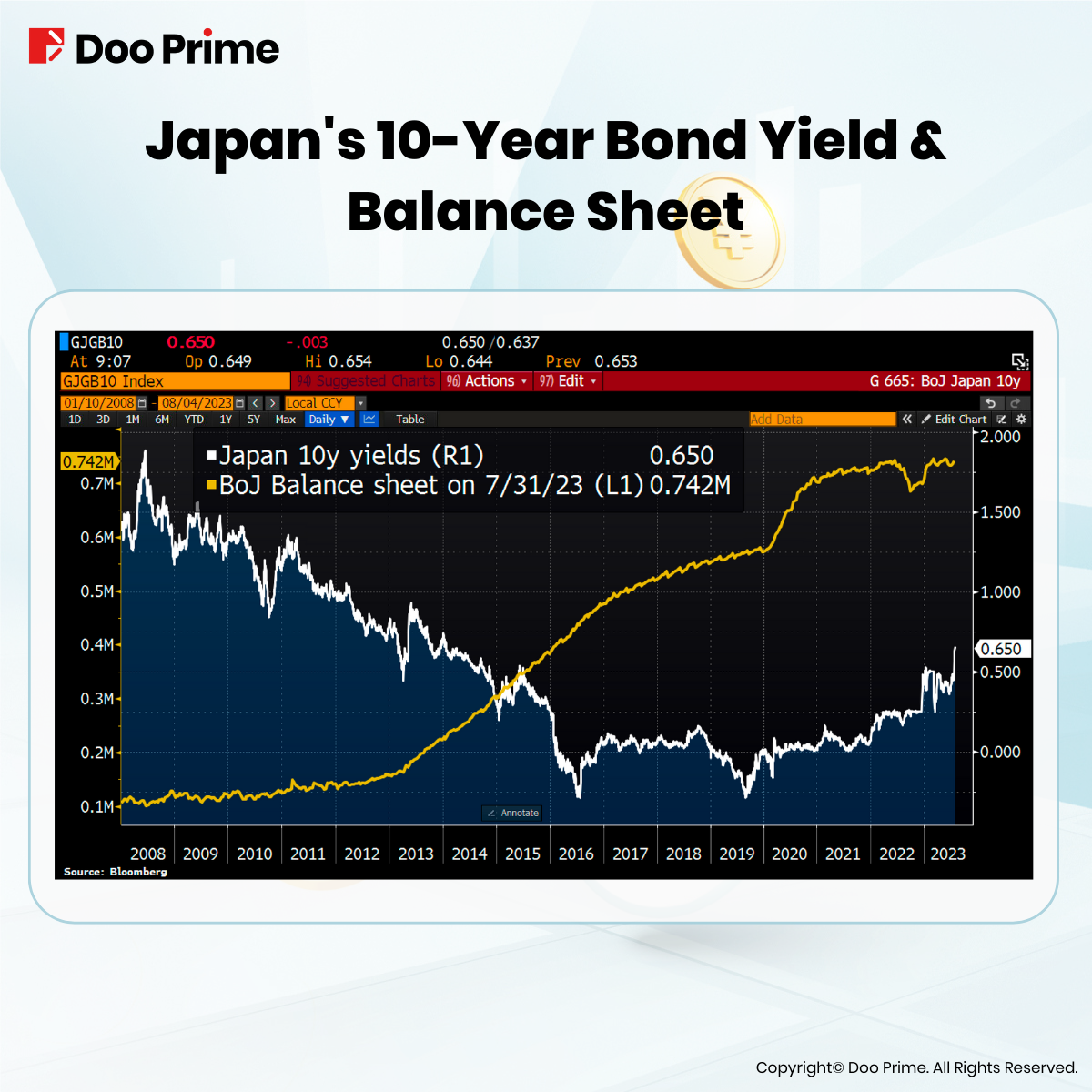

This shift has spurred an intensified market sentiment favoring the divestment of Japanese bonds, directly translating into a marked upsurge in Japanese government bond (JGB) yields.

Crossing the threshold of 0.6%, the 10-year JGB yield has soared to an exceptional high, marking an impressive milestone spanning over nine years, and echoing across global financial landscapes.

The silver lining in this surge of JGB yields lies in its potential to lure back overseas capital. As JGB yields rise, the relative appeal of holding overseas assets wanes.

With enhanced returns on yen-denominated assets, a concurrent market pullback from foreign asset purchases is anticipated, potentially prompting a substantial influx of foreign investment into Japan, projected to reach a total scale of approximately JPY 40 trillion, or USD 280 billion.

This inflow of offshore funds has the potential to invigorate Japan’s economy, particularly bolstering the vitality and valuation of its financial sector.

Conversely, if the 10-year JGB yield frequently approaches or breaches the upper threshold of its volatility range, the Bank of Japan could find itself compelled to amplify its bond purchasing scale. This would elevate the sustained cost of upholding the YCC policy, ultimately leading to a significant expansion of the Bank of Japan’s balance sheet.

Beyond these intricacies, the upward trajectory of the 10-year JGB yield bears implications for Japan’s fiscal landscape. As yields ascend, the burden of future debt obligations and financing costs for the Japanese government escalates. This trajectory consequently heightens the risk of a potential downgrade in Japan’s credit rating.

Japan’s fiscal challenges are substantial, underscored by the Ministry of Finance’s revealing data indicating that the total government debt, loans, and short-term securities had reached a historic pinnacle of JPY 1,270 trillion by March 2023.

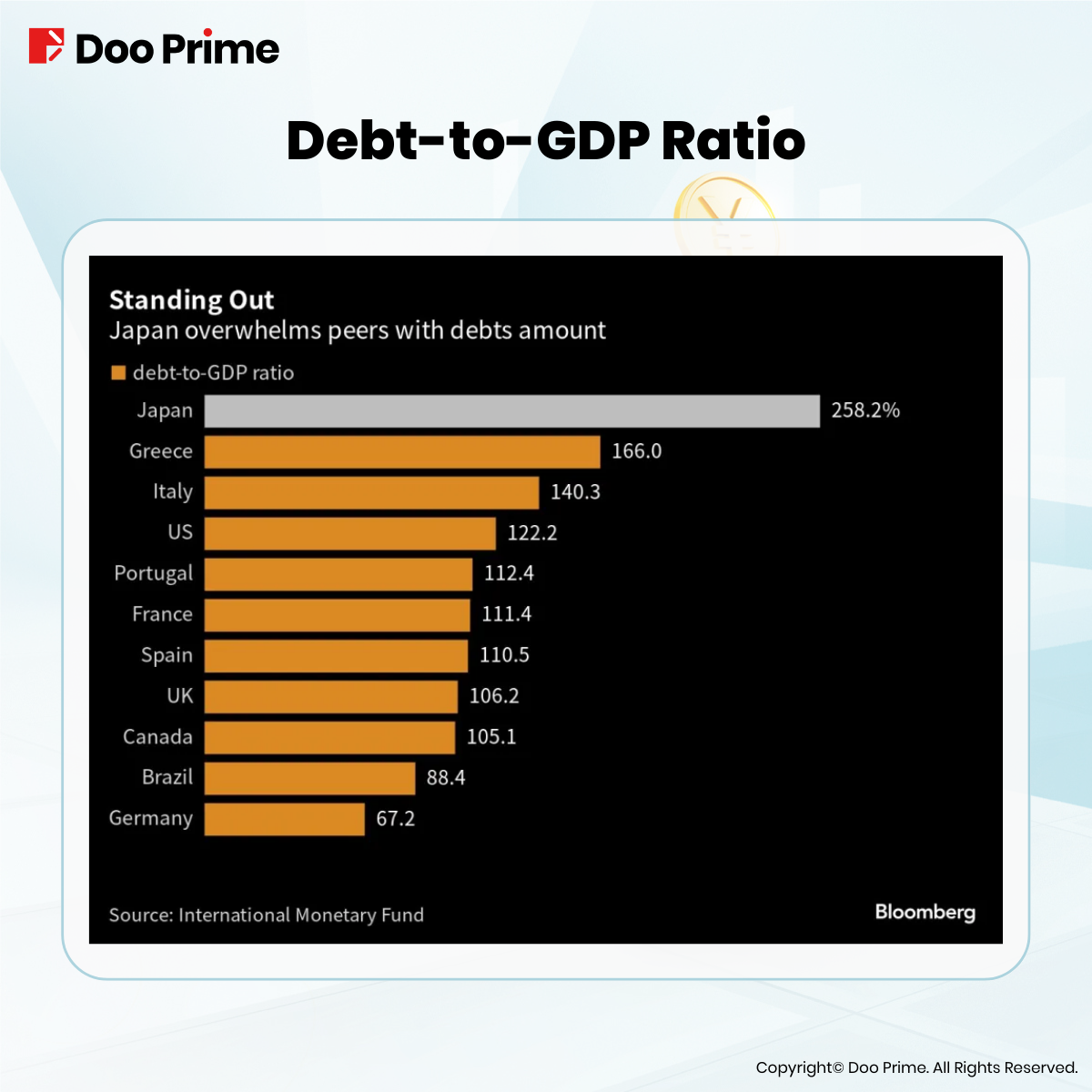

Adding to this fiscal complexity, the International Monetary Fund (IMF) approximates Japan’s debt at an astounding JPY 1,270.499 trillion (equivalent to around USD 9 trillion) as of 2022, representing roughly 260% of its GDP.

With the Bank of Japan loosening its grip on the YCC policy, market apprehensions about Japan’s debt dynamics have heightened. After all, Japan’s credit ranking among G7 nations ranks second from the bottom, only surpassing Italy, which found itself entangled in the European sovereign debt crisis.

The ripple effects of this YCC policy recalibration extend beyond Japan’s bond market, triggering a notable surge in U.S. Treasury yields. Japan has held the esteemed title of the world’s largest creditor nation since 1992, with the United States, France, and the United Kingdom following closely as the top three debtor nations.

The Bank of Japan’s YCC adjustment amplifies pressure on the demand side for U.S. Treasuries, as market speculations about monetary policy normalization intensify. This drives the flow of capital from the U.S. back to Japan, further pressuring U.S. Treasury prices.

In August, the long-term U.S. Treasury market witnessed its most challenging weekly performance of 2023. Simultaneously, the 30-year U.S. Treasury yield crossed the 4.3% threshold for the first time in nearly nine months, accumulating an increment of almost 30 basis points. The 10-year U.S. Treasury yield has similarly surged to a nine-month peak, reaching 4.2%.

In tandem with these developments, Japan’s protracted ultra-loose monetary stance has perennially subdued the yen’s value. Any shift in policy direction invariably bears a substantial impact on the currency.

While the easing of the YCC policy theoretically uplifts the yen, heightened tendencies among investors to offload the currency have emerged.

Year-to-date, the Japanese yen has depreciated by approximately 9.5% against the U.S. dollar, solidifying its position as the weakest performer among major developed currencies.

In the aftermath of the YCC policy adjustment, the yen’s downward spiral continues, with the yen-to-dollar exchange rate briefly touching JPY 145 on August 14th, marking its lowest point since November 2022.

However, the yen has long served as the primary funding source for carry trades. As the yen weakens, the interest rate differential between Japan and foreign economies widens, likely reviving the yen’s role as a funding currency.

In essence, the YCC policy shift has triggered a complex and interconnected web of reactions, extending its impact from domestic bond markets to global financial dynamics and influencing the trajectory of the yen on the world stage.

Will The Bank Of Japan Abandon The Yield Curve Control (YCC) Policy?

For an extended period, the Bank of Japan has leveraged its Yield Curve Control (YCC) policy to sustain a low-interest rate environment as a stimulus for its economy. However, the gradual and persistent rise in inflation has compelled the Bank of Japan to progressively widen the fluctuation range of interest rates.

The unforeseen YCC policy adjustment during the July monetary policy meeting caught markets off guard, introducing greater complexity to the global macroeconomic landscape.

The easing of the YCC policy directly triggered a surge in Japanese government bond yields. While this brought the benefit of enticing overseas capital back into Japan and subsequently bolstering the economy, it also posed challenges such as augmenting the costs for the Bank of Japan to maintain the YCC policy. The weight of burgeoning debt raises concerns about the potential downgrade of Japan’s credit rating.

Furthermore, the massive issuance of U.S. bonds alongside the return of overseas funds to Japan created a scenario where there were few takers for U.S. Treasuries, leading to an increase in U.S. Treasury yields.

The yen, following the YCC policy adjustment, has continued its devaluation trajectory, and the potential expansion of interest rate differentials against other currencies may see it regain its role as a funding currency.

Investors should vigilantly monitor the future actions of the Bank of Japan, especially with regards to a potential complete exit from the YCC policy. Should the Bank of Japan indeed abandon the YCC policy and embark on a monetary tightening trajectory, Japanese government bond rates could face further upward pressure.

Additionally, the yen might experience appreciation pressures, potentially causing ripples across the valuation of global asset categories. As such, the unfolding narrative of the Bank of Japan’s actions holds implications that transcend national borders, casting a shadow over the broader landscape of financial markets.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment, and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please ensure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to learn more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.