In a recent announcement, the Federal Reserve signaled its strategic stance towards the looming expectations of interest rate adjustments, casting a spotlight on the intricate dance between economic indicators and policy decisions. This comes amidst a backdrop of investor anticipation for potential rate reductions as early as June, a move the Fed suggests might be premature given the current economic landscape.

Jerome Powell, the Federal Reserve Chair, emphasized a cautious approach during his address last Friday. Powell highlighted the robust employment figures as a key factor granting the Federal Reserve the luxury of time. The aim is to ensure that any adjustments to interest rates are made with a keen eye on nudging inflation towards the Fed’s 2% target, without undue haste.

This statement was made against the backdrop of the latest data from the Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s favored gauge of inflation, which reported a rise to 2.5% year-over-year. This uptick, although slightly above the Fed’s comfort zone, aligns with broader economic forecasts and is viewed by Powell as a manageable deviation.

The discourse surrounding inflation and interest rates is particularly poignant when considering the significant deceleration in price increases compared to the previous year. Yet, Powell underscored the perils of premature rate cuts, which risk reigniting inflationary pressures, potentially leading to a disruptive cycle of policy reversals.

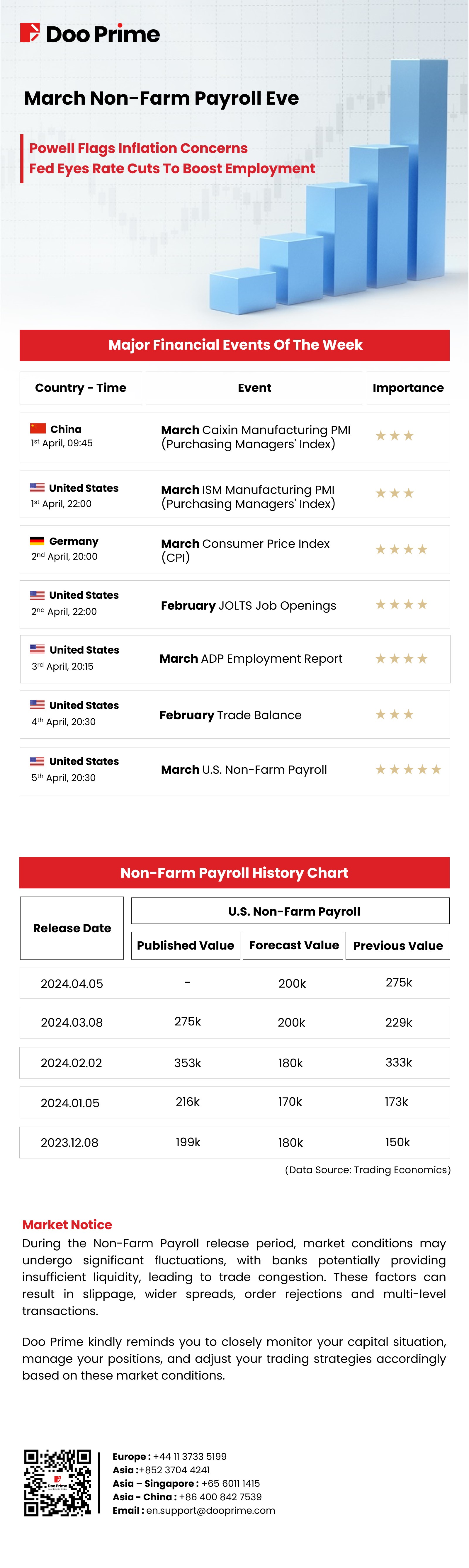

As the market anticipates the next non-farm payroll report, these insights from the Federal Reserve Chair offer a crucial lens through which investors and analysts can gauge the potential trajectory of U.S. economic policy and its implications for global financial markets.